We frequently get questions about whether the Lean process improvement methodology can be applied in the financial services sector. Because of its manufacturing roots, many people assume that Lean doesn't apply to banking or other customer service-oriented industries. However, because banking is very process-intensive, the Lean continuous improvement approach can generate significant operational improvement and waste reduction. That's why many financial institutions have implemented Lean in one form or another.

Opportunities and Challenges Related to Lean Transformation in Financial Services

Lean has significant potential for improving operational efficiencies for process-oriented businesses such as banking. Cost-cutting and error reduction are just the tip of the iceberg. According to The Boston Consulting Group, banks implementing successful Lean programs often see a 15% to 25% improvement in overall efficiency. Reduced cycle time alone can result in a 30% to 60% improvement. Lean thinking can help leaders understand which customer segments are most profitable and where opportunities to enhance customer services can be implemented cost-effectively.

With so much potential, why hasn't Lean banking been more rapidly adopted in the financial services industry? Unfortunately, many people accept that Lean is perfect for manufacturing but need to understand that Lean will work in their organization. However, the truth is that finance is just a different type of factory. It's a factory that processes information, and like any factory, there is a lot of waste management potential. The principles of Lean do not change because you are not producing widgets; they apply just as much to data processing and customer service.

Becoming Lean involves minimizing the seven process wastes: overproduction, waiting, transportation, over-processing, inventory, defects, and motion. It also means maximizing human potential. People practicing Lean are trained to spot and eliminate wasteful practices. As a result, unnecessary steps are managed away, and the entire flow becomes more efficient. When waste disappears, transactions happen faster, and costs go down.

Another essential part of the Lean philosophy is to focus on what matters to the customer. If a process or activity doesn't deliver value for which the customer is willing to pay, it should be eliminated if possible. Understanding what provides value to customers can be challenging, especially when employees are isolated from the frontline. It is common for team members to develop ideas about what is essential to the customer based on an incomplete understanding or limited knowledge. Lean thinking helps solve this by eliminating silos and examining the flow of value from a broader perspective. Customer satisfaction is a key performance indicator for Lean organizations.

Remember that you don't always need to decrease costs to save money. Instead, you need to convert wasteful practices that don't benefit the customer into services that customers value. Again, this thinking centers the customer when developing best practices.

Evolving Mindsets for the Modern Era

Although Lean involves reducing waste, it isn't only about cost-cutting. It's about changing the way that people engage with their work. While the basic ideas may seem obvious, following through with them is more complicated than it may seem. It's similar to your diet. You probably know which foods are healthy and nutritious; it's not hard to understand. Sticking to the stuff that's good for you consistently, on the other hand, takes a lot of work. Habits are hard to break.

Some of the resistance to Lean in financial services is due to its manufacturing origins. Some executives sometimes equate Lean with "dumbing" down a job. Still, others think that Lean requires standardizing every element of a process, but it's actually about getting more intelligent about what you do.

Becoming a Lean manager requires innovative thinking. For example, the steps of a financial process are usually performed in sequential order; even though, in some cases, they could be done in parallel. Instead of applying an assembly line methodology, cycles can speed up dramatically if a race-car pit crew approach is used instead.

Changing the mindset often exposes a significant amount of waste. For example, in their work, Matching Supply with Demand, Gerard Cachon, and Christian Terwiesch found that only 40% of the effort that went into underwriting loans added any value at one large consumer bank. The rest was wasted on unproductive tasks such as processing old loan requests that were unlikely to be accepted by the customer or processing loans that would be rejected because of the applicant's credit score.

Value stream mapping has enormous potential in the financial services sector. It involves visualizing each step in a process and how it connects with every other step. Once the current state is well understood, process operators and leaders can look for gaps or unnecessary activities that might be targeted for elimination.

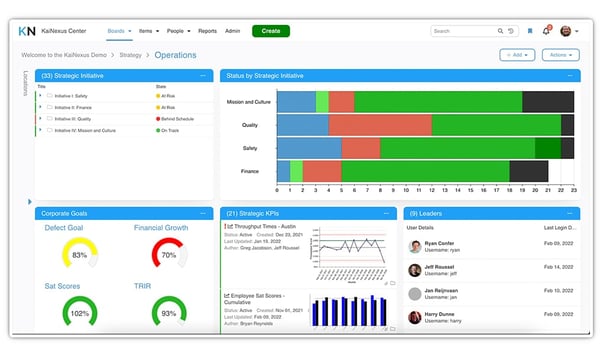

Another factor driving the adoption of Lean in financial services is the availability of Lean software that allows organizations to measure the impact of improvement work in hard numbers that leaders in banking like to see. For example, with the right technology, you can measure and report on cost reduction, customer satisfaction, processing times, and other KPIs that are important to the organization's goals.

Minimizing Risk in a Culture of Change

While extremely useful, the Lean approach is not risk-free. Quality control and risk management must improve as systems become more efficient. One defect can quickly snowball into a bigger problem in a system with little slack. In the same way that Lean manufacturing encourages organizations to operate on a zero-inventory basis and sure that parts from suppliers will have zero defects, banks practicing Lean must have strict quality controls. Standardization improves operations by reducing errors and reducing exposure.

The key to reducing risk in a culture of constant change is ensuring that change is managed and implemented thoughtfully. Lean software helps by creating a repository for knowledge and a dashboard for tracking many current efforts to innovate.

Therefore, the first step to risk management is implementing standard work. When the current best practice for each activity and process is documented and communicated, you form the foundation upon which change can be built. The standard is only adjusted after a completed improvement cycle, such as PDSA or DMAIC.

Another risk mitigation approach is strategy deployment. When employees know about the organization's strategic direction and understand how their work relates to the most critical breakthrough goals, they are better positioned to make good decisions and embark on improvement projects that move the organization closer to its primary objectives.

Putting People First

While the Lean theory is pretty simple, the execution is complicated because it's a people process that requires a significant shift in the culture and the way activities are managed. Although Lean may seem like an operations issue, it's a management practice that requires organizations to interact with workers in new, unfamiliar ways. For example, the Lean principle of engaging employees in improvement means that workers involved in a process must be asked how it could be improved. The people dimension of Lean can not be an afterthought. Changing the way people behave must be addressed from the start. Employees are more likely to resist change if they don't know how to help improve the process and understand how their efforts equate to value. Lean works best as both a top-down and bottom-up effort.

One common Lean practice that centers people is the Gemba Walk. Leaders go to the workplace to observe, ask questions, and show respect. Changes are not made during the Gemba walk. However, if an opportunity for improvement is identified, an improvement cycle may be started later. Gemba walks are tricky in the modern era of remote work. Still, leaders can use video meetings and phone calls to understand how people are working, what challenges they face, and what improvement tactics might help.

Lean must be tailored for the banking industry, but the fundamental principles hold. Organizations with a common goal, well-defined expectations, and strong executive commitment are well-positioned for success.

![[Watch Now] How to Leverage Lean for Long-Term Success](https://no-cache.hubspot.com/cta/default/326641/eb5ac7b8-b040-48b7-810e-1589561ffff9.png)

![[Watch Now] Components of an Employee-Led Lean Initiative](https://no-cache.hubspot.com/cta/default/326641/a91195a9-a959-420e-b46f-d1a97a8175ba.png)

Add a Comment