We recently had the honor of hosting Nick Katko, President and Owner of BMA and author of several books, including The Lean CFO - 2nd Edition and co-author of Practicing Lean Accounting, on a webinar with KaiNexus Senior Advisor Mark Graban, and Senior Director of Lean Strategy, Chris Burnham.

In this webinar, Connecting Continuous Improvement to the Bottom line, you will learn how to make the true cause-effect relationships between continuous improvement and financial improvement visible throughout the organization. Integrating these relationships will improve the quality of business decision-making and leverage continuous improvement for financial success for the entire organization. This post is a recap of Nick's presentation. However, the webinar contains many more valuable examples, so we highly recommend that you watch the webinar here.

Connecting Continuous Improvement to the Bottom Line

Presented by Nick Katko, President & Owner of BMA

Changing Your Thinking Habits

To connect continuous improvement to the bottom line, you must understand how Lean works financially. Anytime someone brings up the 'bottom line', a dollar or monetary sign typically appears in their head. Nick has learned over the years that although he had always thought it was about the numbers as the bottom line, it was really about thinking habits. If you've been involved in any analytical practice, you use numbers. Those numbers drive your thinking, that thinking drives behavior, that behavior drives decisions, those decisions drive the numbers, & the cycle continues. The challenge in connecting continuous improvement to the bottom line is that when starting this 'cycle', the numbers you use in continuous improvement may not be applicable in a Lean environment. You have to change your thinking habits now to achieve your Lean goals better.

Economics of Lean

How Lean works financially, or the Economics of Lean, is really important for your entire organization to understand in the same way. From Senior Leaders down to Line Managers, everyone in a Lean company practicing continuous improvement must understand this.

When you implement any continuous improvement activity, the primary result is creating capacity (whether that's eliminating waste, saving time, etc.). What you do with that capacity determines the actual financial benefit. With the additional capacity, you can provide a higher value for your customers or, over time, achieve cost reduction. This is what leads to sustainable financial success! Think about how you would better your organization with additional time and/or capacity.

Cause & Effect: Improved Financial Performance

In traditional financial thinking, financial targets are set, and the rest of the organization is told to hit those targets. But in continuous improvement, we look at this a bit differently. Meaning the improved financial performance is the effect, and the cause is the improved operating performance and improved capacity performance.

There are several outcomes where Lean thinking drives financial performance including:

-

Increasing sales without increasing fixed costs

-

Reducing fixed costs as a % of sales

-

Reducing variable costs improves contribution margin

-

Increasing capacity without increasing costs

-

Improving performance and increasing capacity

-

Improving cash flow

Box Score: A Tool to Drive New Thinking Habits

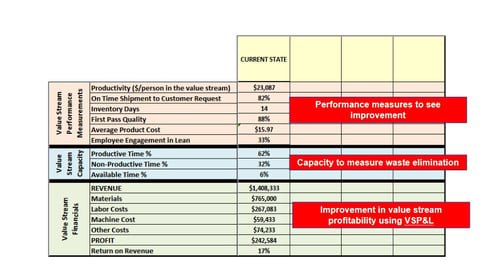

Earlier, we discussed how Lean thinking inherently changes how you think about analysis and decision-making. The Box Score gives visibility and insight into these things. The Box Score is typically divided into three sections:

1) What are the Lean performance measurements?

2) What is the value stream? What are the actual costs?

3) How much capacity are we creating?

You can see that this becomes a tool to use to drive the thinking and to connect continuous improvement to the bottom line.

Below is an example of Box Score.

Check out the webinar to dive into examples using the Box Score.

Measuring Capacity in Order to Measure Improvement

If we want to measure improvement, it's important to measure all types of capacity:

-

Available Capacity: Time created through improvements

-

Nonproductive Capacity: Time spent on non-value added activities (necessary and waste)

-

Productive Capacity: Value add activity time

-

Total available time: Total time of resources

How Lean Achieves Cost Reduction

It's important to understand how Lean achieves cost reduction. Many Lean objectives lead to more cost avoidance vs. actual cost savings, which improves cost measurements over time. Nick strongly advises against measuring improvement with any cost allocation method (ex. product cost, cost per patient, etc.) and numbers that have been "GAAP adjusted" for financial reporting. The problem here is that sometimes it can mask what is really going on with costs. This is why it's important to have a proper Lean cost performance measure over time. Watch the webinar recording to find more examples on this topic.

Conclusion

In conclusion, the key outcome of continuous improvement efforts produces some type of additional capacity. Focusing on these outcomes will significantly improve your long-term financials.

To end with a few pieces of advice:

-

Your executives and accounting teams need to experience continuous improvement and see the value of investing in it. Instill in them work in continuous improvement WILL lead to financial improvement.

-

Integrate the Economics of Lean and Use the Box Score in all analysis and decision-making.

-

In continuous improvement, distinguish between short-term vs. long-term impact.

If you want to learn more, check out the BMA website & subscribe to his emails for information about monthly webinars, blogs, & online courses & certifications. Remember to subscribe to the BMA YouTube channel as well.

Watch the live audience Q&A at the end of the webinar recording here.

Add a Comment